Annual income after taxes calculator

Enter your info to see your take home pay. Determine your annual salary.

Income Tax Formula Excel University

Web Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

. Web If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Start New Jersey Tax Rate Estimator. Web The calculator calculates gross annual income by using the first four fields.

This yearly salary calculator will. Annual Income 15hour x 40. Try out the take-home calculator choose the 202223 tax year and see how it.

That means that your net pay will be 45925 per year or 3827 per month. This places US on the 4th place out of 72 countries in. Web Before tax thats an annual salary of 61828.

Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Enter the gross hourly earnings into the first field. That means that your net pay will be 43041 per year or 3587 per month. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

That means that your net pay will be 37957 per year or 3163 per month. After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand. Federal tax State tax medicare as well as social security tax allowances.

If your employer pays you by the hour multiply your hourly wage by the number of hours your work each week. Web If you make 55000 a year living in the region of New York USA you will be taxed 11959. It can also be used to help fill steps 3 and 4 of a W-4 form.

All other pay frequency inputs are assumed to be holidays and. Rates remain high in Melbourne where median weekly earnings top. Youll agree to either an.

Web If you make 55000 a year living in the region of Texas USA you will be taxed 9076. That means that your net pay will be 36398 per year or 3033 per month. You can use our Irish tax calculator to estimate your take-home salary after taxes.

Web After deducting taxes the average single worker in Sydney takes home 53811 yearly or 4484 per month. Web Step 1. Web How to Use the Tax Calculator for Ireland.

Web The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Web With five working days in a week this means that you are working 40 hours per week. Web If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602.

For a single filer living in New York City with an annual income of 65000 the annual take home pay. Web See Your Federal and New Jersey Taxes. Just type in your gross salary select how frequently.

Using the annual income formula the calculation would be.

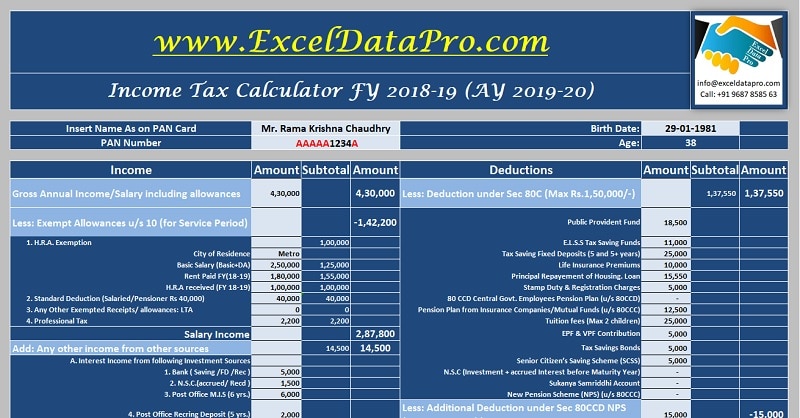

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax In Excel

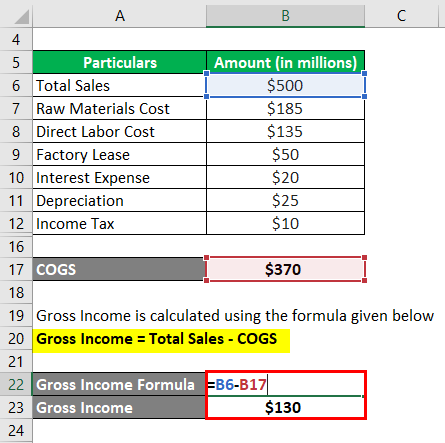

Gross Income Formula Calculator Examples With Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Income Tax Calculating Formula In Excel Javatpoint

Gross Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

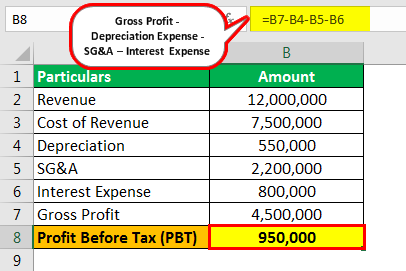

Profit Before Tax Formula Examples How To Calculate Pbt

How To Calculate Income Tax In Excel

After Tax Uk Salary Tax Calculator

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example